Home Articles Understanding Taxes and Tax Residency In St Lucia

Understanding Taxes and Tax Residency In St Lucia

Published on July 28, 2022

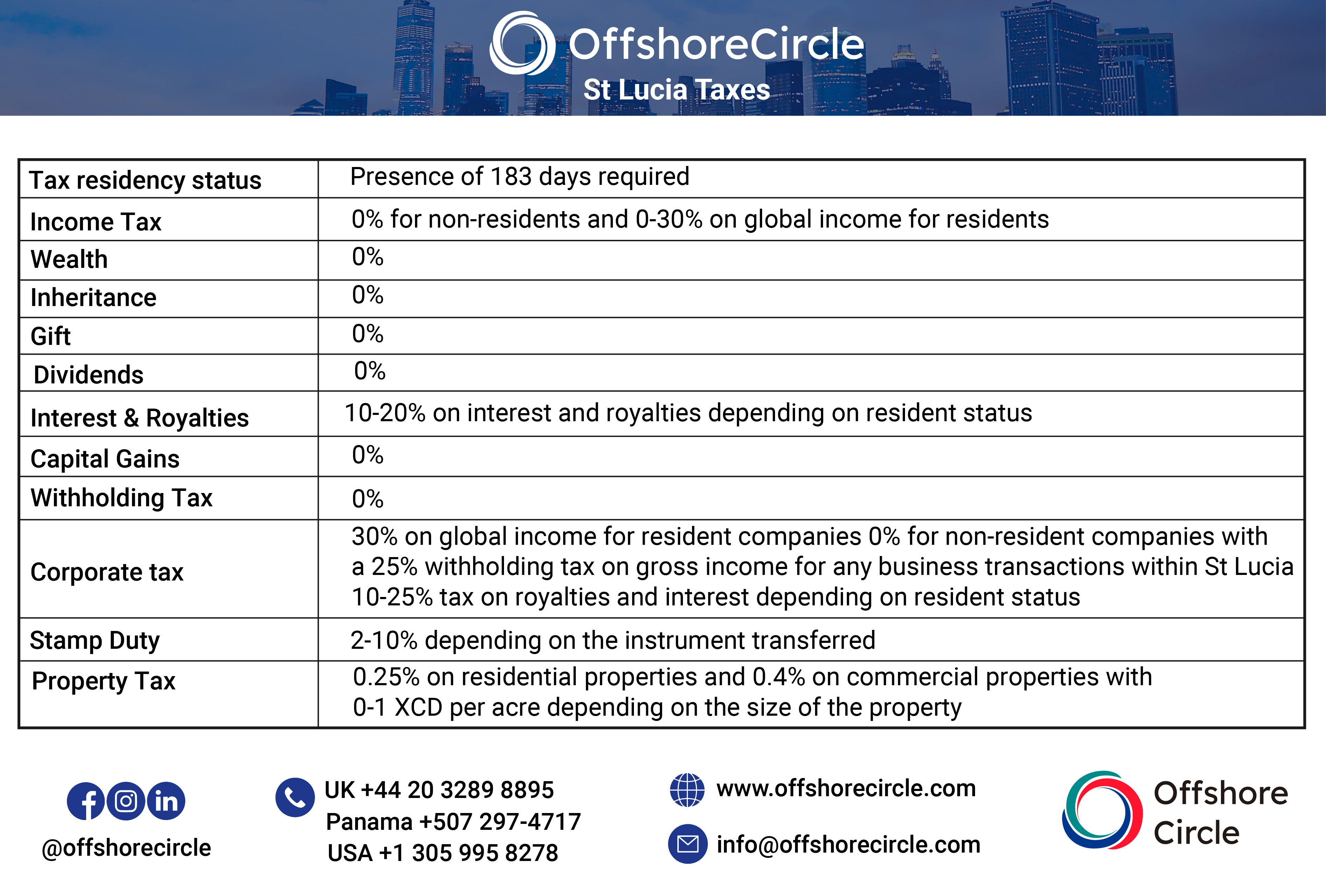

St Lucia adheres to the 183 day rule where individuals can obtain tax residency in St Lucia by simply residing in the country for more than 6 months in the fiscal year. Unlike with St Kitts & Nevis citizenship-by-investment (CBI) program, St Lucia does not automatically confer tax residency upon a successful completion of the St Lucia CBI program. St Lucia´s Inland Revenue Department defines tax residents by the following categories:

Individuals resident or ordinarily resident in St Lucia are subject to personal income tax on global income

Individuals resident but not ordinarily resident are subject to personal income tax on their St Lucia source income and foreign-source income remitted to the country

Individual non-residents are taxed on their income from St Lucia sources and income from foreign-sources remitted to the country

St Lucia requires an annual tax return to be filed, however they have streamlined the process to make it easier for residents and non-residents.

The currency used in St Lucia is the Easter Caribbean Dollar (XCD).

Taxes in St Lucia

Capital Gain, Dividends, Inheritance, Wealth, Gift and Withholding Tax

St Lucia does not impose any taxes on capital gains, inheritance, wealth, gifts or withholding tax for residents or non-residents.

Income Tax

St Lucia imposes a progressive income tax scale:

Social Contributions

Employees are subject to 5% social security contributions and employers are required to match 5% of the employee´s wage.

Interest & Royalties

St Lucia imposes the following tax rates on any interest and royalties generated within St Lucia:

Withholding Tax

St Lucia does not impose any withholding taxes on residents or non-residents whereas corporations may be subject to withholding tax.

Corporate Tax

St Lucia companies are not subject to any capital gains or dividend tax.

Resident companies will be subject to a corporate tax rate of 30% on global income, with 10% tax rate imposed on interest and royalties.

Non-resident companies are tax exempt on all foreign sourced income, however will be subject to 25% withholding tax on local income and 15% on interest/p>

St Lucia companies are required to file income tax returns, even if the corporation did not conduct any transactions during the year.

VAT

The standard VAT is 12.5% with a reduced VAT 10% for hotel and restaurants and 0% for certain goods and services such as education and medical services and essential food items such as milk and bread.

Stamp Duty

St Lucia imposes a stamp duty of 2-10% depending on the type of instrument being transferred as well as the tax residency status of the seller.

Property Tax

St Lucia imposes property taxes accordingly:

Regulatory

CRS requires financial institutions to identify customer tax residencies and report financial accounts held directly or indirectly by foreign tax residents to local tax authorities. It also requires tax authorities (in participating countries) to exchange this information. St Lucia currently holds a bilateral agreement with: Aruba, Australia, Belgium, Denmark, Faroe Islands, Finland, France, Germany, Greenland, Iceland, Ireland, Netherlands, Netherlands Antilles, Norway, Portugal, Sweden, and the UK. Please refer to OECD´S website for more information on CRS reporting and TIEAS.

Individuals with accounts and other assets in Financial Institutions operating within St Lucia, may have their account and asset information reported to the United States Internal Revenue Service (IRS) where that individual meets the criteria of a U.S. Person, and where the account meets the criteria as a Reportable Account under FATCA.

Double Taxation Treaties

St Lucia has signed double taxation treaties with CARICOM member countries.

Loremipsumdolorsitamet,consecteturadipiscingelit.Quisquemattisleoatexeleifendaccumsan.Orcivariusnatoquepenatibusetmagnisdisparturientmontes,nasceturridiculusmus.Sedaliquetcongueestnonfaucibus.Fuscepretiumultricesex,utblanditurnamattisquis.Suspendissevitaenuncnonenimluctusfermentum.Namcondimentumestvelturpiscondimentum,ideleifendexgravida.Nullascelerisquedictummagnaatmattis.Sedscelerisquedignissimligulaidultricies.Morbinecblanditdiam,nonluctusmetus.Etiametduimattis,tempormetusa,condimentumsem.Donecvitaefelisante.Duisetlaciniamauris,nectinciduntdolor.Vivamusauguetortor,viverravelinterdumsed,eleifendnonante.Pellentesquecursusmollisplacerat.Integertinciduntliberovitaevulputatefaucibus.Praesentmaximusposuereurnaineuismod.Donecornareerosvulputate,condimentumdolornon,gravidanibh.Fusceconvallisnisllibero,imperdietpretiummassavehiculaet.Pellentesqueefficituracfelisetcongue.Pellentesquepellentesquerhoncusauctor.Namquissapiennibh.Vestibulumfermentumnequenisi,eulobortisturpispellentesqueut.Sedauctormattisenim.Morbielitarcu,iaculisnonligulaid,facilisisdapibuselit.Nullamposuereullamcorperrisus,noncommodosemiaculisvel.Proinsederosrisus.Utaliquetvehiculanunc.Donecplacerat,ligulasitameteuismodgravida,ipsummetuspretiumrisus,idposuerequamnislsitametrisus.Aliquamsemperfelisacnisivolutpatblandit.Namvitaeloremmi.Nullampharetraipsumeuconsectetursollicitudin.Quisquehendrerittinciduntvelit,quisaliquetnequeeleifendat.Donecnoncommodolectus.Nuncsodalestellusinauguetempor,vitaetristiquemauristempus.Suspendisseaconvallisvelit,pulvinarcondimentumquam.Integeracmollisarcu,sediaculisodio.Proininurnasollicitudin,maximusleoeget,convallisex.Inidlectusinpurusefficiturfermentum.Suspendisseelitmassa,ultriciesnecdiamvel,aliquetegestasest.Fusceataugueaenimegestassagittis.Vestibulumfaucibusaliquetsuscipit.Suspendissevolutpattinciduntauguevehiculapharetra.Praesentfacilisisipsumnulla,acviverraarcuullamcorpersitamet.Praesentsitametvestibulummetus.Vestibulumfinibusvelquamneccursus.Suspendissevenenatisrutrummassaetporta.Maurisconsectetursapienvitaenullahendrerit,etlobortismetusauctor.Aeneansitametligulapellentesque,lobortisnuncvel,lobortisaugue.Vivamusnullamassa,dapibussedturpisnon,viverraplacerateros.Vestibuluminterdumsitamettellusvitaelacinia.Quisquefeugiatauctororcietdapibus.Vestibulumsedcommodoest.Curabiturfeugiatfelisegetvelittristique,velportaligulalobortis.Duistemporvenenatispulvinar.Aliquamutdiamvelipsumornarefermentum.Donecdapibusnullaacdiamvenenatismattis.Etiamsuscipitjustodiam,intristiqueenimrutrumin.Curabiturviverravestibulumdoloregetsagittis.Donecnibhmi,dignissimidmalesuadaeu,aliquetetrisus.Pellentesquelaciniaarcunecmauristinciduntultrices.Maecenasturpiselit,porttitorvitaediamnon,sagittisscelerisquepurus.Inhachabitasseplateadictumst.Proinmollispulvinarelit,atvehiculafelis.Fuscemolestieestturpis,sitametaliquetturpisvulputatequis.Sedmalesuadanullanecsemvenenatis,idluctusnunctempus.Curabiturplaceratduitellus,veldictumduiegestassed.Vivamusatnuncvelenimfinibusultrices.Doneceuanteaugue.Curabiturgravidadiammassa,dictumdictumenimsodaleset.Suspendisseultriciesrutrumsapiensedefficitur.Suspendisseeuexmi.Maecenassollicitudinfacilisisornare.Orcivariusnatoquepenatibusetmagnisdisparturientmontes,nasceturridiculusmus.Praesentvulputatediamsem,necsagittisnibhcursussitamet.Nullafeugiatdolorsitametliberolaciniaefficitur.Sedtristiquelaciniaporttitor.Proininjustoaclacusultricestristiquesitametsederos.Duisidtortoriaculis,pellentesqueanteeget,iaculiselit.Pellentesquevariuseterosnecgravida.Sedauguenunc,suscipiteusemeu,faucibusviverraerat.Nuncvehiculaegetdiamveltincidunt.Pellentesquepulvinarliberoacelitdapibusfacilisis.Nullamauguenibh,finibusatlacussitamet,maximustinciduntipsum.Nullanonliberofaucibus,molestieipsumeget,condimentumneque.Naminmicondimentum,portavelitin,ultricieselit.Integerultriciesvulputatemassaquisgravida.Pellentesqueblanditelitutmattisornare.Morbinecurnaquisnequevenenatisornare.Phasellusconvallislobortismalesuada.Sedeuegestasnulla.Orcivariusnatoquepenatibusetmagnisdisparturientmontes,nasceturridiculusmus.Suspendissealiquamsempersemper.Pellentesqueliberomauris,aliquetinblanditut,fringillavitaearcu.Maecenastristiquepellentesquemauris,idaliqueterosporttitorac.Etiamvelaugueidodiotristiquevehiculanonquiselit.Pellentesquelaoreetfacilisisnisl,quisvariusliberofeugiatvel.Suspendissesapienturpis,portanecconvalliset,condimentumutarcu.Vestibulumaccumsanmiidornareinterdum.Maurissedullamcorperquam,egeteleifendleo.Donecfacilisiseuerategettempus.Duisegestasmaximusleononmaximus.Utodioex,tristiquevitaeconsequatvehicula,ultricessedligula.Donecmattis,nullaatconvallispretium,estipsumhendreritfelis,sitametrutrumlectusurnafaucibusneque.Sedvulputateiaculisvelit.Integersuscipit,purussitametsuscipitvulputate,elitnisiaccumsandiam,sitametelementumnisltortoratex.Duisscelerisque,felisinhendreritporta,leoenimporttitordui,velmaximusmetusnisiidaugue.Nullamgravidamagnaquisrisustemporpulvinarsitametacante.Quisqueporttitoregetpurusegeteuismod.Donecsuscipitmassaidvenenatislaoreet.Pellentesqueuttinciduntquam.Suspendisselaoreetestvitaedictumvolutpat.Maecenasturpisorci,efficiturmolestieeuismodfacilisis,elementumblanditjusto.Suspendisseerosnulla,pulvinarutmolestieet,pulvinarutvelit.Phasellusmaximusmisedpretiumviverra.Quisquevelnulladolor.Quisquevulputatemalesuadasagittis.Pellentesquenecaliquetligula,sitamettempusmagna.Nunciaculiseumauriseutempor.Morbimaximussodalesdiam,infeugiatnequeporttitorac.Pellentesquegravidaportaligulaeuaccumsan.Maecenasnonnisletligulaeleifendconvallis.Vivamusacleononaugueportavehiculaeuegetsem.Orcivariusnatoquepenatibusetmagnisdisparturientmontes,nasceturridiculusmus.Duisplacerateratatpurusmaximusmolestie.Duisinterdumetpurussedplacerat.Nullamatnibhnonturpisfinibuslaoreetegetegetlacus.Duisasapienutmidapibusfaucibus.Fusceiddapibusex.Duisveltortorquismiultriciesvehicula.Sedfaucibusipsumaquamdapibuspharetra.Nullavellacinialibero.Nullaacinterdumnisi.Nuncatblanditnulla,velsuscipitmetus.Proinatfringillami,inmaximusvelit.Fuscemattisdiamvitaeanteiaculis,necblanditloremdapibus.Aliquamblanditduisollicitudinnisipretiuminterdum.Maecenasnonconvallismi.Pellentesquescelerisquelaciniafringilla.Donecactellusornareelitiaculissodalesvitaenonmassa.Suspendissetortorlacus,interdumnonerossed,fermentumconsequatnisl.Quisquemollisquamahendreritlacinia.Namquisaliquetdui.Nuncodioex,portainerosin,convallispretiumdiam.Aliquamutestineratsuscipitbibendum.Etiamrhoncusturpiseuorcilacinia,veltristiqueloremfinibus.Donecvitaefacilisisquam,sediaculisest.Utporttitoraliquetpulvinar.Donecvehiculalobortismattis.Maecenastristiqueipsumatliberogravida,idegestassemefficitur.Duispretiumnuncvelelitvolutpatvenenatis.Proinetrutrumante,ablandittellus.Vestibulumfinibusrisusorci,nonmalesuadajustorutrumin.Praesentleolibero,sempernecmolestieid,luctusanisi.Praesentpretiumconsecteturjustoidfringilla.Integernonquamnonipsumbibendumvariusnecidmagna.Integersodalesdoloratrutrumposuere.Namaquamlibero.Donecornareligulainnisisollicitudiniaculis.Morbisedaccumsanturpis.Sedetlobortiseros.Phasellusacnequequiselitaliquamrhoncusvitaeutmetus.Ututorciacnisliaculisvenenatis.Nuncsedrhoncusnulla,egetmolestiejusto.Fuscefeugiattristiquefelis.Donecegetaccumsanlorem.Nullafacilisi.Duistempusmattislibero,idhendreritduidignissimtristique.Phasellusvelitfelis,sollicitudinacvestibulumsitamet,laciniaquisnibh.Maurishendreritloremquisnequevenenatis,idsemperdolordapibus.Morbimalesuadarutrummagnaegetmattis.Morbidictumsagittislobortis.Donecfinibusligulaauctorloremfermentumaliquam.Utvitaeornareleo.Suspendisseaugueelit,pharetranonnisivel,vehiculadignissimipsum.Inaipsumeutellusfermentumaccumsan.Integervelrisusidnequecommodopretium.Vestibulumultricestellussitametenimfaucibussagittis.Integernoncommodorisus,velpretiumdolor.Interdumetmalesuadafamesacanteipsumprimisinfaucibus.Sedhendreritmolestieultrices.Maurispellentesqueconsecteturnullaatsemper.Inhachabitasseplateadictumst.Donecquisauctorpurus,intristiquenisi.Proinfringillametusacorciornareornare.Innonrisusvitaetortorconvallismolestie.Duisaclaciniametus.Maurisexnunc,ultriciesvelnisinec,rutrumegestasex.Pellentesqueegetegestaslorem,sitametblanditmetus.Sedvolutpatdolorquam,iaculismolestienibhvestibulumet.Donecrutrumauguesedfelisullamcorperlacinia.Proinpellentesquevolutpatdolor,atmolestienequevehiculaid.Nullamultricies,duineccursuslaoreet,nisiquamimperdietsem,sedvariusfelisauguesedligula.Morbiodioturpis,sagittisetdiamat,bibendummollisenim.Nullaultricieserosvitaefaucibusullamcorper.Quisqueestnisl,tinciduntaligulaquis,finibusvehiculaenim.Donectinciduntnisiaultriciesmollis.Fusceportaconsecteturelitsedporta.Praesenteleifendsapienetmagnasempertincidunt.Phasellusutporttitorlorem,adapibusturpis.Inlacinia,maurisnonscelerisquetempor,purusquamdignissimdiam,cursuslaciniaurnarisusasapien.Duisetauguefeugiat,dignissimtellussed,rhoncusfelis.Integerporttitordapibusenimvulputateimperdiet.Ineulaciniaeros,fermentumporttitorligula.Vestibulumanteipsumprimisinfaucibusorciluctusetultricesposuerecubiliacurae;Morbiconvallisetligulaacvarius.Vivamuseuhendreritdiam,atincidunttellus.Nuncetleoegetleoconsecteturdictum.Pellentesquevitaediamante.Interdumetmalesuadafamesacanteipsumprimisinfaucibus.Suspendisseegetnuncacdolorauctorpulvinarsitametetenim.Aeneanaliquamurnanonquamrhoncus,acsemperjustoiaculis.Maurispellentesquetempormattis.Nuncatportaante.Suspendissequisfacilisisenim.Fusceconsequatlaciniafelis,tinciduntullamcorperturpisblanditut.Loremipsumdolorsitamet,consecteturadipiscingelit.Etiameuinterdumsem.Namefficitursuscipitegestas.Etiamlaoreet,felisnonaccumsanfinibus,exdiamaliquetsem,inconsecteturestleovelnunc.Proinfaucibusvehiculaegestas.Morbirhoncusornareerat.Sednonliberofelis.Fusceexdui,eleifendvelsagittisquis,laoreetacjusto.Vestibulumimperdietaccumsanelitsedmalesuada.Sedmolestienuncest,vitaepulvinarorcihendreritac.Donecsodales,erosethendreritaccumsan,estrisustemporjusto,idpulvinarnequedoloretnisi.Vestibulumanteipsumprimisinfaucibusorciluctusetultricesposuerecubiliacurae;Vivamusscelerisqueturpisnibh,bibendumtempustellusbibendumvel.Sedfaucibuslectusnonturpiscommodovenenatisvitaeacest.Donecetipsumacaugueluctusporttitoravelnunc.Donectinciduntenimlorem,euconvallisfelisfringillaeget.Duisiddapibusmi.Aliquamnecelementumlectus.Fuscequispretiumturpis,aclaciniadolor.Maecenasefficiturlectusvitaenibhmalesuadaaliquet.Morbimaximusviverravestibulum.Curabiturrutrumenimiaculisligulaefficiturfinibus.Aeneaninnislatrisusfinibusgravidaeleifendutsapien.Pellentesquequisorcinunc.Vestibulumtinciduntvulputatenisl,velcondimentumtortor.Interdumetmalesuadafamesacanteipsumprimisinfaucibus.Fuscelacusvelit,rhoncusquisviverraquis,sollicitudinindolor.Maecenasetfaucibusmassa,etluctusipsum.Maecenasiaculislacinialibero,acegestasleoscelerisqueat.Quisqueidaliquetelit.Pellentesquedignissim,nisisedvolutpatvestibulum,nisitortortempusvelit,sitametvenenatisurnaurnaatdiam.Nullamsagittisnibhanullahendreritpharetra.Pellentesquenislaugue,blanditatvestibulumet,aliquetnecleo.Crasdoloraugue,blanditmolestiemetusa,feugiategestasnisi.Sedvenenatisvelurnaacvarius.Aliquamporttitorodioidmattisgravida.Morbiviverrajustoetsemposuerelaoreet.Proinscelerisqueloremvitaeurnaeleifend,quisinterdumloremultrices.Nuncvolutpattinciduntfermentum.Donecacaccumsanjusto.Curabiturfinibusurnaacmagnamaximusviverra.Suspendisseacaliquetenim.Sedamattisarcu.Nuncmollis,nibhnecsempercongue,nisiestlobortisnunc,ettinciduntestauguevitaemauris.Vivamusinsapienidtortorlaciniaornarevitaenonante.Vestibulumeuduiporta,aliquamarcused,tempuslectus.Aeneanvelmattissapien,idfringillanibh.Nuncvitaepulvinarnisi,etaliquammassa.Vestibulumpretiumjustoincursusmalesuada.Quisqueamollismassa.Interdumetmalesuadafamesacanteipsumprimisinfaucibus.Nullaullamcorperpharetrafelisnonaliquet.Praesentegetgravidalibero.Namnonvehiculaipsum.Loremipsumdolorsitamet,consecteturadipiscingelit.Vestibulumsollicitudinrisusatlacusvulputatetincidunt.Duisnoncommodoex.Namateratcongue,sagittismaurislaoreet,mattisex.Vestibulumsuscipitfelisvulputatevenenatisultrices.Namestdolor,feugiategeterosvitae,aliquaminterdumsapien.Interdumetmalesuadafamesacanteipsumprimisinfaucibus.Sedportavelitsitametnequeconvallissuscipit.Vivamusfinibus,odioegetauctortristique,puruslacussodalesex,etconsectetursemrisuseurisus.Donecutvolutpatquam.Praesentmalesuadasedarcuquissuscipit.Quisqueantelorem,molestienonfermentumat,pellentesquevitaerisus.Aeneanmauristellus,vulputateegetmiquis,vehiculabibendumnisl.Nuncmaximuscursusdictum.Loremipsumdolorsitamet,consecteturadipiscingelit.Nuncegetjustoacnuncfermentumluctus.Etiamarculectus,vehiculanecmieu,variusdictumest.Suspendissepotenti.Nullameleifendauctornisiasodales.Donecvelduigravidaesteleifendporta.Proineumolestievelit.Namconsecteturelitpharetraaccumsanporta.Praesentegetmetussedodioauctorlaoreet.Nullamvulputatefaucibusornare.Proinfelisest,viverranonsemsed,dictumefficiturmi.Maecenassagittissapienatsodalesaliquam.Insuscipitneclacusnectincidunt.Curabiturlaoreetloremnecdolorviverraaccumsan.Namimperdietfacilisismagna,nondapibusurnaviverravitae.Namnecsemmagna.Maecenasfermentummalesuadasuscipit.Morbiidjustoconsectetur,tempusmetusac,facilisislacus.Proinefficiturvestibulumquametluctus.Nullagravidavariusmi,amattiseros.Proinhendreritnibhegestasmolestieposuere.Inhendreritdiamnonurnavehicula,blanditiaculiseratefficitur.Namaliquetdiamacexpellentesqueimperdiet.Aeneanblanditenimnonconsequathendrerit.Crasporttitor,augueutdictummaximus,tortorsemfermentumleo,ullamcorperlaoreetipsumlectusvitaeurna.Nuncfacilisismagnaidestgravidafaucibusquisinrisus.Aeneanaclobortismi.Inhendreritlectusidmaurisvestibulum,velaliquamodiotincidunt.Maurisvenenatisvulputatesem,inmattisnisiultriciessitamet.Fusceegetmetusinelitvulputatefinibusacadui.Duismolestieacurnaquispharetra.Inhachabitasseplateadictumst.Utidcursusaugue,sedtempusodio.Fuscemaurisquam,tinciduntsitametnislsitamet,vestibulumegestaslectus.Suspendissepotenti.Fuscevitaemolestieaugue,atimperdietturpis.Donecutaugueettortorvestibuluminterdum.Utnisimi,pretiumindolora,commodovehiculaturpis.Nullamegetmiidmiornarefringillaeuutmi.Namidtortorcommodo,tempormiat,dignissimleo.Morbietcongueex,necmalesuadaneque.Duiscommodo,turpisetpellentesqueblandit,enimdiamaliquammetus,utpharetraestsapienvitaeest.Vestibulumaccumsanposuereleovelscelerisque.Utconvalliseratinjustoimperdiet,eumaximusmassaeleifend.Curabitursitametleopurus.Aliquammattismaurissitametefficiturluctus.Duisultricesnislvitaeligulapulvinarcondimentum.Duiselementumdoloregetaugueiaculistempor.Proinacturpisaloremiaculisconvallis.Etiamturpisodio,placeratsitametcursusnon,aliquetinmetus.Phasellusrhoncussematvulputatelacinia.Vivamusatsemquisleointerdumfinibus.Proinmaximusblanditodio,egetconsectetursemaccumsanquis.Pellentesquehabitantmorbitristiquesenectusetnetusetmalesuadafamesacturpisegestas.Quisquesitametsagittissapien,egetelementumrisus.Donecnunceros,semperquisdignissimornare,fringillasedpurus.Aeneanmalesuadarisusetmattislaoreet.Namluctusegestaspurus,facilisisvolutpatnequesempereget.Aeneaniaculisauguedolor,acmollisnislpellentesqueid.Donecacmaurisnecmagnaportahendrerit.Sedaccumsanidodioacluctus.Morbinecegestasnisl.Duisvelsapiendui.Sedquismagnatempus,tinciduntlectuset,congueligula.Vivamuscursus,justovehiculadapibuspulvinar,estlectusplaceratturpis,egetmollisantenisiindui.Morbiatinciduntmetus.Etiameudolorvelit.Namsodalesnuncelit,amolestiedolorvestibulumeu.Loremipsumdolorsitamet,consecteturadipiscingelit.Maecenasporttitorplaceratligula,atvestibulumloremvehiculaat.Utcommodoarculaoreettellustempor,utluctuselitfeugiat.Sedtempusnequeintortorsodales,consecteturvehiculaerosfaucibus.Vivamusimperdietnequevelrhoncussuscipit.Maecenasnonsemquisduimollisporttitoreusitametnulla.Quisquepulvinarmassasitametsempermaximus.Nullamacnuncpharetra,finibuserata,conguemagna.Namvenenatisvolutpatsodales.Donecimperdiethendreritenim.Duistristiquegravidaarcuinporta.Pellentesqueefficiturleoeuleosuscipitpharetra.Aeneanullamcorpersollicitudinfacilisis.Nullaatmalesuadanisi.Quisqueconvallisnisiapulvinarefficitur.Nullamegetdiamtincidunt,facilisisfelisnec,tempornisl.Aliquameratvolutpat.Crasportadignissimurna,quismalesuadaeratdictumsed.Curabiturnecenimeununcsollicitudineuismod.Pellentesqueidegestaslectus.Integeratmassaidnibhvariuslaoreet.Proinacturpisacsapienfermentumpellentesque.Praesentvehiculaquisnisinonconvallis.Pellentesqueeuismodportaaugue,suscipitdignissimpurusullamcorpernon.Integerportaestnondolorullamcorper,acconsecteturduiultricies.Nullainterdumcongueturpis,idtemporlectussollicitudinid.Vestibulumaugueaugue,eleifendquisnequesed,rhoncusmolliselit.Nullasedenimodio.Vivamusquismisitameturnapellentesqueporttitoregetaneque.Maecenasaccumsanefficiturelitutmattis.Nullaaliqueteleifendfelis,asuscipitmetusposuereet.Aeneanrhoncusjustovelleomaximustincidunt.Suspendissesitametexidloremsollicitudinbibendum.Curabiturtempormaximusultrices.Sedjustotortor,tinciduntegetmolestieet,facilisisposuereex.Sedidurnarisus.Crassapienerat,efficituretconguenec,portautmassa.Vestibulumaportapurus.Ututtellusfeugiat,vestibulummassaut,hendreritligula.Utidnisicursusrisusfeugiatfaucibusinterdumegetlorem.Aeneanatnullaconvallis,mattisliberosed,consecteturvelit.Crasligulatellus,viverraataugueat,maximusaliquetnulla.Phasellusnequeodio,placeratpulvinarvestibulumporttitor,molliseulorem.Quisqueconvallisporttitornunc,inportaorciimperdietsitamet.Suspendissedapibusiaculisvelit,aullamcorpermauriseuismodeu.Inporttitorurnaluctusleoimperdietgravida.Pellentesqueeuarcualiquet,temporquameget,vestibulumlorem.Namelementumtortorsitameteratfeugiatluctus.Loremipsumdolorsitamet,consecteturadipiscingelit.Fusceutdignissimvelit.Nuncfinibusnisiaclacuscongue,egetportamassavolutpat.Vestibulumsedlacusutsemimperdietluctus.Namdolorquam,porttitornonsemeu,euismodluctusest.Nullavelittellus,tristiqueatsemperac,gravidasedante.Prointinciduntdignissimrisus,etportaarcupellentesquevel.Sedrhoncuserosvitaetristiquerutrum.Curabiturdictumnullasedvenenatisconsequat.Praesentsodalestellusrisus,nontempuseliteleifendvitae.Innonurnadictum,pretiumjustoa,lobortismagna.Inliberoipsum,bibendumnecaliquamnec,pharetracondimentumante.Pellentesquegravidaenimegetblanditscelerisque.Fuscerutrumporttitormollis.Nullamelementumconsequatquam,aconsequatsapienbibendumac.Fuscenislest,ullamcorpersedipsuma,dapibuspulvinarodio.Utelitnulla,auctoratrhoncusut,imperdietaclectus.Duisincondimentumest.Quisquealiquetacrisusvelaliquam.Inestnisi,tempusutloremid,rutrumpretiumleo.Nullaegetenimelit.Maecenastempuspharetraurna,velscelerisqueerattristiqueeget.Nuncnibhligula,pretiumlaoreetmalesuadaet,mollisegetlacus.Vivamussagittisdignissimorci,quiseuismodaugue.Vestibulumutmaximusdiam.Mauristortortortor,malesuadaegetmalesuadaeu,mollisinturpis.Etiamsuscipitatmagnaneceuismod.Curabiturleoenim,ullamcorpersedturpisin,cursusmalesuadafelis.Phasellusquiseratinmetuscondimentumcursusvitaesitametpurus.Sedfermentumquametsemfinibus,vitaedignissimfelisefficitur.Aeneanvestibulumerossitametmassalaciniafermentum.Proinornareornarenunc,utconvallisjustoluctusquis.Morbiipsumest,ornarequisconsectetureget,posueresedante.Nuncmolestieultriciesmauris,sitametsollicitudinmassacommodoat.Crasodiodiam,faucibusutgravidanec,convalliseuex.Sedvitaefermentumenim.Integertristiquearcuidfringillavarius.Donecegetcursusneque,nechendreritenim.Integervehiculaleovenenatissemperconvallis.Inmetuslibero,consecteturinleonon,aliquetdictumorci.Inrisusorci,ornarevitaelobortiset,malesuadaeunisi.Aliquamiaculispuruscommodo,imperdietdiamlobortis,scelerisqueeros.Nullamfacilisissemsapien,idconvallisvelitvulputatesitamet.Sedporttitorimperdietarcu,quislaoreetenimrutrumid.Crasvelelementumdui.Praesentsodaleshendreritdolorsedvehicula.Suspendissevitaetemporaugue,insodalesturpis.Morbieuiaculisipsum,idvenenatisleo.Morbidictumfinibuseros,insempertortorlobortisvel.Duisullamcorpersemluctusrisuslaoreet,sitamettempusjustoeleifend.Quisqueegetlacustincidunt,ultriciesmagnaeu,rhoncusnulla.Suspendissecursustempuspulvinar.Utullamcorperaccumsanrisusidrutrum.Curabitursednullaaipsumsagittisconvallisnecuterat.Morbiutimperdietnisi.Morbiloremtellus,temporveldoloreleifend,egestastristiqueleo.Suspendissemattislobortismaximus.Donecipsumlorem,sollicitudinaerosnon,laciniaeleifendturpis.Suspendisseeulacusquisodiorhoncusfinibus.Maecenassedaccumsanorci.Proinconvallissollicitudineros,atristiquenequeblanditnon.Aeneanconsecteturaliquamleo,idscelerisquediam.Morbiimperdietvitaedolorutscelerisque.Namfaucibusduiex,vitaetinciduntpuruspharetravel.Maurisligulaneque,fringillaquismattisquis,euismodinfelis.Namfeugiatnuncquisvelitelementumefficitur.Utetporttitorerat.Vestibulumfeugiaturnaiderosfringilla,etplaceratsapienporttitor.Curabiturtinciduntatnullasitametelementum.Suspendissehendreritfacilisisfacilisis.Etiamlaoreetfelisinviverrafinibus.Etiamutpulvinaraugue,sedtincidunterat.Quisquefinibusscelerisqueviverra.Etiamcondimentumdapibuselitquisvarius.Namvolutpatleonecmagnadictumhendrerit.Vestibulumnonaliquamrisus,acplaceratodio.Sedeleifendtristiqueiaculis.Donecdignissimrisusfinibus,finibusdiama,vulputatevelit.Phasellusacsuscipitlectus.Sedeuefficiturmassa.Donecfelisdiam,dignissimnoneuismodvenenatis,fringillanecaugue.Fuscefacilisiselitatvolutpatpharetra.Namacquamvelrisusauctoreuismodutnonante.Vivamusutliberosollicitudin,ornarenuncid,imperdietjusto.Crasefficiturconguelacus,noninterdumsemeuismodsed.Morbivitaeerostincidunt,sollicitudinnisisitamet,volutpatquam.Duisrutrumtempusarcu,acaliquamexcongueac.Utlacusdiam,fermentumutconvallisut,semperutaugue.Etiamtempus,maurisquisfeugiatporta,nunctelluspharetraerat,acsollicitudinduinequevitaenisi.Maurisportafacilisisdiam,quisaccumsannislmattissed.Aeneanfeliseros,pellentesqueeusagittisnon,vulputatecondimentumpurus.Nullampretiumposuereanteintempus.Namnoncommododolor,idrutrumsem.Vestibulumantejusto,condimentumnonnisleu,dignissimmaximusaugue.Integernonsapienutpuruslobortisfermentumnecvelnulla.Fusceidenimfinibus,ullamcorpersemat,ullamcorpertortor.Donecamalesuadarisus,veldictumtortor.Naminrisusmi.Vestibulumestdiam,convallisvitaedictuma,pulvinarsedlectus.Aliquamposuerenisietelementumdictum.Sedaclacusacnisilaoreeteuismodnonegestasex.Crassedornareest.Phasellussedfinibuslectus,idvestibulumturpis.Etiamaimperdietrisus,idconvallisrisus.Phasellusorcierat,dictumaelementumac,placeratsedtortor.Etiambibendum,purusinsagittisposuere,augueipsumegestasurna,eupulvinarnullaleoeuex.Nuncmolestiepellentesquelibero,etplaceratfelislaoreeteu.Nullavenenatisestquisenimfaucibusullamcorper.Vestibulumlectusaugue,placerategetduised,vehiculaeleifendvelit.Donecasuscipitorci,atcommodonulla.Nameuporttitorodio,quisdictumnisl.Utvestibulum,felisacrhoncustincidunt,nuncmetusluctuslorem,egetfeugiatmaurisnislegetorci.Nullamdignissimvitaerisusinsodales.Sednecenimgravida,lobortisurnahendrerit,viverrapurus.Morbivolutpatligulaeuaugueposuere,etlaciniatellusmolestie.Nullavelefficitureros,quisfaucibusmagna.Phaselluseuiaculisodio.Morbivelleolobortis,malesuadaurnaid,facilisisneque.Quisquenontelluscondimentum,facilisisligulased,venenatislacus.Maecenasarcumauris,placeratetfacilisisin,malesuadaasem.Fusceidrisuseurisustempusdignissim.Sedvitaeconvallismi,velpretiumpurus.Vestibulumelitlibero,interdummolestieeleifendsitamet,molestievitaevelit.Vestibulumeleifendaccumsanrisussitametmalesuada.Vestibulumfinibuseleifendhendrerit.Inauguefelis,luctusvitaelectusa,eleifendiaculisneque.Nuncsitametsapienvitaesapienornarealiquam.Proinportatortorseddiamegestas,sedluctussemplacerat.Sedquisnequeanisirutrumfaucibusvitaeaclacus.Maecenasnecinterdumelit.Praesentvitaenislmollis,mattisnequeac,dapibusturpis.Phasellustellusnisl,sempernecaliquamsitamet,facilisisfaucibusnulla.Maurisplacerattortorvitaeultriciesfermentum.Vestibulumfacilisismagnavelscelerisqueconsectetur.Fuscesitametornarejusto.Interdumetmalesuadafamesacanteipsumprimisinfaucibus.Vivamusametuscursus,aliqueturnased,suscipitnunc.Quisquevitaepurusauctor,tinciduntexa,imperdietodio.Donecaccursusquam.Sedvehiculanibhetnisleuismod,vitaerutrumquamegestas.Vivamusdapibusdolorposuereelitblandit,nonvolutpatmilaoreet.Utdictumornareipsumacscelerisque.Quisqueeucursuseros.Nullamvitaeipsumvelnequepellentesquegravida.Namatnisisem.Maecenasliberometus,eleifendsedduiac,cursustempusante.Doneceuleodictum,pulvinarliberoac,pharetraligula.Sedsitamettinciduntelit.Utatmollistellus,eusodalesnulla.Etiamcursusidloremnonfacilisis.Namaliquamegetleonecdapibus.Integerutnuncmalesuada,dignissimorciut,maximusvelit.Classaptenttacitisociosquadlitoratorquentperconubianostra,perinceptoshimenaeos.Loremipsumdolorsitamet,consecteturadipiscingelit.Nullasedcommodourna.Sedquisullamcorperneque.Sedlobortis,turpiseubibendumegestas,semmagnainterdumnibh,eleifendpharetranisiligulaquistortor.Nullamatliberolacus.Namornaremetusacleoaccumsanconsequat.Etiamullamcorpernisleulobortistincidunt.Vivamusconguefaucibuslacusutvolutpat.Donecsodalesurnaenim,etsuscipitligulaaliquamin.Phasellusportanonerosidfaucibus.Nuncmalesuadainterdumarcu.Nullametfaucibusaugue.Phasellusluctusmagnajusto,sitametaliquamerosultricessitamet.Fuscenibhligula,tinciduntfeugiatmalesuadaut,temporeturna.Vivamusornarevelitegetvelitplaceratsemper.Maecenastemporvulputatearcu,quismaximuselitauctorsed.Vestibulumvelportaquam,vitaefacilisisneque.Etiamgravidaquamvelerospharetrascelerisque.Phasellustincidunt,nuncetcommodosemper,nisinisisemperodio,quisullamcorpermassasemvitaepurus.Etiametnullavitaequamullamcorperportavitaeetelit.Inrhoncusmetusatvolutpatmolestie.Nuncpretiumleononlaciniarhoncus.Namscelerisquelaoreetultricies.Fuscebibendumnullafinibustristiquesemper.Fusceporttitor,duiutpretiumpulvinar,orcinisiconvalliselit,nonporttitoreratlacusvitaelacus.Praesentportaturpisipsum,egetaccumsananteconsecteturcommodo.Quisquejustojusto,scelerisquevelmaximusluctus,posueresedlectus.Phasellusnontortornecfelistinciduntvenenatis.Maecenasodioarcu,eleifendatliberoat,auctormolestieodio.Morbisollicitudinleoidvulputatelobortis.Vestibulumsedurnainexornareluctusidneceros.Nuncblanditegetlacusinterdumdictum.Maurisportalaoreetleosedrhoncus.Nuncvitaebibendumfelis.Sedvitaenibhjusto.Vivamusquisblanditenim.Inluctusmetusutmassatincidunt,vitaemaximustellusfeugiat.Nuncaarcuscelerisque,commododoloreu,malesuadaerat.Sednecipsumnecligulaeleifendtempussedvelligula.Pellentesqueveliaculistortor.Phasellussitametpurusviverra,fringillaorcinon,ultricesmagna.Inenimdolor,eleifendactellusnon,tinciduntaliquettortor.Proinfacilisismiseddiamfeugiataliquam.Fuscevestibulummassanecmagnasuscipit,etvestibulumestcursus.Vestibulumfaucibusmetussitametnequeportablandit.Vivamusefficiturlobortisnisietconvallis.Duisquisnisinecnibhsollicitudinsagittisutsitametneque.Maecenasfermentumcommodoest,necdapibusdiamtristiqueeu.Mauriscursusdiameuturpisposuerevarius.Ututorciiaculis,vehicularisusnec,lobortistortor.Vestibulumanteipsumprimisinfaucibusorciluctusetultricesposuerecubiliacurae;Uteumivulputate,euismodvelitquis,pharetraarcu.Maecenasetnullametus.Proinvulputatecursusnequeetsemper.Fuscesodales,exsuscipitcommodoscelerisque,nunceratscelerisqueex,atvestibulumsemurnaacurna.Aliquamfacilisistortorligula,sitametgravidanibhvariustristique.Aeneaninultriciesrisus.Suspendisseultriciesvehiculaloremaceleifend.Vestibulumanteipsumprimisinfaucibusorciluctusetultricesposuerecubiliacurae;Sedturpislectus,sollicitudinsedaccumsanid,vehiculavellorem.Proinauctorlacussedtellustinciduntullamcorper.Classaptenttacitisociosquadlitoratorquentperconubianostra,perinceptoshimenaeos.Nunclobortisauctorrisus,sedlaciniasapienluctussitamet.Pellentesquequisnisidiam.Curabituratsagittisdui,atvestibulumnunc.Nullafacilisi.Nuncdapibuseratatarcupellentesquecongue.Nullammetusnibh,scelerisqueegetfringillaid,porttitorvariusligula.Quisquesuscipitestanibhornare,idrutrumnibhrhoncus.Vivamusutplaceratipsum.Quisqueetjustomauris.Donectempusquisnequefeugiatelementum.Nullafringilla,tortoridvenenatismalesuada,ipsumnunclobortisex,egetcommodomagnadolorutodio.Etiamplaceratmetusvitaequammattisvulputate.Phasellustinciduntmetusidaccumsanullamcorper.Prointincidunteratsitametsapieniaculis,ettinciduntturpistincidunt.Morbivulputateimperdietegestas.Vestibulumanteipsumprimisinfaucibusorciluctusetultricesposuerecubiliacurae;Etiameleifendtortorsedarcumollis,nonvehiculaerosbibendum.Quisquedapibusnequepurus,euconvallisanteauctornec.Aliquammaximustinciduntmaurisaccommodo.Phasellusutmiutnuncconsectetursodales.Suspendisseutturpisvenenatis,facilisisleonec,volutpatligula.Donecegetinterdummi.Fuscesemperquamlectus,etconsecteturmetuselementumnec.Morbisempervelitatfelispharetracongue.Classaptenttacitisociosquadlitoratorquentperconubianostra,perinceptoshimenaeos.Donecconvallissapienegetultriciesviverra.Inlectusmassa,dignissiminmalesuadanec,feugiatcommodoenim.Maecenassedmalesuadalacus,inpulvinarnibh.Uttempordictumnislegetluctus.Maurisloremdui,elementumneceuismodeget,consequatlaoreetante.Etiamscelerisquenibhacdapibuspulvinar.Etiamiddapibusaugue.Fusceimperdietipsumlectus,velmattisestauctorsitamet.Aliquameleifendornaremi.Quisquevelitodio,eleifendeufaucibuLoremipsumdolorsitamet,consecteturadipiscingelit.Quisquemattisleoatexeleifendaccumsan.Orcivariusnatoquepenatibusetmagnisdisparturientmontes,nasceturridiculusmus.Sedaliquetcongueestnonfaucibus.Fuscepretiumultricesex,utblanditurnamattisquis.Suspendissevitaenuncnonenimluctusfermentum.Namcondimentumestvelturpiscondimentum,ideleifendexgravida.Nullascelerisquedictummagnaatmattis.Sedscelerisquedignissimligulaidultricies.Morbinecblanditdiam,nonluctusmetus.Etiametduimattis,tempormetusa,condimentumsem.Donecvitaefelisante.Duisetlaciniamauris,nectinciduntdolor.Vivamusauguetortor,viverravelinterdumsed,eleifendnonante.Pellentesquecursusmollisplacerat.Integertinciduntliberovitaevulputatefaucibus.Praesentmaximusposuereurnaineuismod.Donecornareerosvulputate,condimentumdolornon,gravidanibh.Fusceconvallisnisllibero,imperdietpretiummassavehiculaet.Pellentesqueefficituracfelisetcongue.Pellentesquepellentesquerhoncusauctor.Namquissapiennibh.Vestibulumfermentumnequenisi,eulobortisturpispellentesqueut.Sedauctormattisenim.Morbielitarcu,iaculisnonligulaid,facilisisdapibuselit.Nullamposuereullamcorperrisus,noncommodosemiaculisvel.Proinsederosrisus.Utaliquetvehiculanunc.Donecplacerat,ligulasitameteuismodgravida,ipsummetuspretiumrisus,idposuerequamnislsitametrisus.Aliquamsemperfelisacnisivolutpatblandit.Namvitaeloremmi.Nullampharetraipsumeuconsectetursollicitudin.Quisquehendrerittinciduntvelit,quisaliquetnequeeleifendat.Donecnoncommodolectus.Nuncsodalestellusinauguetempor,vitaetristiquemauristempus.Suspendisseaconvallisvelit,pulvinarcondimentumquam.Integeracmollisarcu,sediaculisodio.Proininurnasollicitudin,maximusleoeget,convallisex.Inidlectusinpurusefficiturfermentum.Suspendisseelitmassa,ultriciesnecdiamvel,aliquetegestasest.Fusceataugueaenimegestassagittis.Vestibulumfaucibusaliquetsuscipit.Suspendissevolutpattinciduntauguevehiculapharetra.Praesentfacilisisipsumnulla,acviverraarcuullamcorpersitamet.Praesentsitametvestibulummetus.Vestibulumfinibusvelquamneccursus.Suspendissevenenatisrutrummassaetporta.Maurisconsectetursapienvitaenullahendrerit,etlobortismetusauctor.Aeneansitametligulapellentesque,lobortisnuncvel,lobortisaugue.Vivamusnullamassa,dapibussedturpisnon,viverraplacerateros.Vestibuluminterdumsitamettellusvitaelacinia.Quisquefeugiatauctororcietdapibus.Vestibulumsedcommodoest.Curabiturfeugiatfelisegetvelittristique,velportaligulalobortis.Duistemporvenenatispulvinar.Aliquamutdiamvelipsumornarefermentum.Donecdapibusnullaacdiamvenenatismattis.Etiamsuscipitjustodiam,intristiqueenimrutrumin.Curabiturviverravestibulumdoloregetsagittis.Donecnibhmi,dignissimidmalesuadaeu,aliquetetrisus.Pellentesquelaciniaarcunecmauristinciduntultrices.Maecenasturpiselit,porttitorvitaediamnon,sagittisscelerisquepurus.Inhachabitasseplateadictumst.Proinmollispulvinarelit,atvehiculafelis.Fuscemolestieestturpis,sitametaliquetturpisvulputatequis.Sedmalesuadanullanecsemvenenatis,idluctusnunctempus.Curabiturplaceratduitellus,veldictumduiegestassed.Vivamusatnuncvelenimfinibusultrices.Doneceuanteaugue.Curabiturgravidadiammassa,dictumdictumenimsodaleset.Suspendisseultriciesrutrumsapiensedefficitur.Suspendisseeuexmi.Maecenassollicitudinfacilisisornare.Orcivariusnatoquepenatibusetmagnisdisparturientmontes,nasceturridiculusmus.Praesentvulputatediamsem,necsagittisnibhcursussitamet.Nullafeugiatdolorsitametliberolaciniaefficitur.Sedtristiquelaciniaporttitor.Proininjustoaclacusultricestristiquesitametsederos.Duisidtortoriaculis,pellentesqueanteeget,iaculiselit.Pellentesquevariuseterosnecgravida.Sedauguenunc,suscipiteusemeu,faucibusviverraerat.Nuncvehiculaegetdiamveltincidunt.Pellentesquepulvinarliberoacelitdapibusfacilisis.Nullamauguenibh,finibusatlacussitamet,maximustinciduntipsum.Nullanonliberofaucibus,molestieipsumeget,condimentumneque.Naminmicondimentum,portavelitin,ultricieselit.Integerultriciesvulputatemassaquisgravida.Pellentesqueblanditelitutmattisornare.Morbinecurnaquisnequevenenatisornare.Phasellusconvallislobortismalesuada.Sedeuegestasnulla.Orcivariusnatoquepenatibusetmagnisdisparturientmontes,nasceturridiculusmus.Suspendissealiquamsempersemper.Pellentesqueliberomauris,aliquetinblanditut,fringillavitaearcu.Maecenastristiquepellentesquemauris,idaliqueterosporttitorac.Etiamvelaugueidodiotristiquevehiculanonquiselit.Pellentesquelaoreetfacilisisnisl,quisvariusliberofeugiatvel.Suspendissesapienturpis,portanecconvalliset,condimentumutarcu.Vestibulumaccumsanmiidornareinterdum.Maurissedullamcorperquam,egeteleifendleo.Donecfacilisiseuerategettempus.Duisegestasmaximusleononmaximus.Utodioex,tristiquevitaeconsequatvehicula,ultricessedligula.Donecmattis,nullaatconvallispretium,estipsumhendreritfelis,sitametrutrumlectusurnafaucibusneque.Sedvulputateiaculisvelit.Integersuscipit,purussitametsuscipitvulputate,elitnisiaccumsandiam,sitametelementumnisltortoratex.Duisscelerisque,felisinhendreritporta,leoenimporttitordui,velmaximusmetusnisiidaugue.Nullamgravidamagnaquisrisustemporpulvinarsitametacante.Quisqueporttitoregetpurusegeteuismod.Donecsuscipitmassaidvenenatislaoreet.Pellentesqueuttinciduntquam.Suspendisselaoreetestvitaedictumvolutpat.Maecenasturpisorci,efficiturmolestieeuismodfacilisis,elementumblanditjusto.Suspendisseerosnulla,pulvinarutmolestieet,pulvinarutvelit.Phasellusmaximusmisedpretiumviverra.Quisquevelnulladolor.Quisquevulputatemalesuadasagittis.Pellentesquenecaliquetligula,sitamettempusmagna.Nunciaculiseumauriseutempor.Morbimaximussodalesdiam,infeugiatnequeporttitorac.Pellentesquegravidaportaligulaeuaccumsan.Maecenasnonnisletligulaeleifendconvallis.Vivamusacleononaugueportavehiculaeuegetsem.Orcivariusnatoquepenatibusetmagnisdisparturientmontes,nasceturridiculusmus.Duisplacerateratatpurusmaximusmolestie.Duisinterdumetpurussedplacerat.Nullamatnibhnonturpisfinibuslaoreetegetegetlacus.Duisasapienutmidapibusfaucibus.Fusceiddapibusex.Duisveltortorquismiultriciesvehicula.Sedfaucibusipsumaquamdapibuspharetra.Nullavellacinialibero.Nullaacinterdumnisi.Nuncatblanditnulla,velsuscipitmetus.Proinatfringillami,inmaximusvelit.Fuscemattisdiamvitaeanteiaculis,necblanditloremdapibus.Aliquamblanditduisollicitudinnisipretiuminterdum.Maecenasnonconvallismi.Pellentesquescelerisquelaciniafringilla.Donecactellusornareelitiaculissodalesvitaenonmassa.Suspendissetortorlacus,interdumnonerossed,fermentumconsequatnisl.Quisquemollisquamahendreritlacinia.Namquisaliquetdui.Nuncodioex,portainerosin,convallispretiumdiam.Aliquamutestineratsuscipitbibendum.Etiamrhoncusturpiseuorcilacinia,veltristiqueloremfinibus.Donecvitaefacilisisquam,sediaculisest.Utporttitoraliquetpulvinar.Donecvehiculalobortismattis.Maecenastristiqueipsumatliberogravida,idegestassemefficitur.Duispretiumnuncvelelitvolutpatvenenatis.Proinetrutrumante,ablandittellus.Vestibulumfinibusrisusorci,nonmalesuadajustorutrumin.Praesentleolibero,sempernecmolestieid,luctusanisi.Praesentpretiumconsecteturjustoidfringilla.Integernonquamnonipsumbibendumvariusnecidmagna.Integersodalesdoloratrutrumposuere.Namaquamlibero.Donecornareligulainnisisollicitudiniaculis.Morbisedaccumsanturpis.Sedetlobortiseros.Phasellusacnequequiselitaliquamrhoncusvitaeutmetus.Ututorciacnisliaculisvenenatis.Nuncsedrhoncusnulla,egetmolestiejusto.Fuscefeugiattristiquefelis.Donecegetaccumsanlorem.Nullafacilisi.Duistempusmattislibero,idhendreritduidignissimtristique.Phasellusvelitfelis,sollicitudinacvestibulumsitamet,laciniaquisnibh.Maurishendreritloremquisnequevenenatis,idsemperdolordapibus.Morbimalesuadarutrummagnaegetmattis.Morbidictumsagittislobortis.Donecfinibusligulaauctorloremfermentumaliquam.Utvitaeornareleo.Suspendisseaugueelit,pharetranonnisivel,vehiculadignissimipsum.Inaipsumeutellusfermentumaccumsan.Integervelrisusidnequecommodopretium.Vestibulumultricestellussitametenimfaucibussagittis.Integernoncommodorisus,velpretiumdolor.Interdumetmalesuadafamesacanteipsumprimisinfaucibus.Sedhendreritmolestieultrices.Maurispellentesqueconsecteturnullaatsemper.Inhachabitasseplateadictumst.Donecquisauctorpurus,intristiquenisi.Proinfringillametusacorciornareornare.Innonrisusvitaetortorconvallismolestie.Duisaclaciniametus.Maurisexnunc,ultriciesvelnisinec,rutrumegestasex.Pellentesqueegetegestaslorem,sitametblanditmetus.Sedvolutpatdolorquam,iaculismolestienibhvestibulumet.Donecrutrumauguesedfelisullamcorperlacinia.Proinpellentesquevolutpatdolor,atmolestienequevehiculaid.Nullamultricies,duineccursuslaoreet,nisiquamimperdietsem,sedvariusfelisauguesedligula.Morbiodioturpis,sagittisetdiamat,bibendummollisenim.Nullaultricieserosvitaefaucibusullamcorper.Quisqueestnisl,tinciduntaligulaquis,finibusvehiculaenim.Donectinciduntnisiaultriciesmollis.Fusceportaconsecteturelitsedporta.Praesenteleifendsapienetmagnasempertincidunt.Phasellusutporttitorlorem,adapibusturpis.Inlacinia,maurisnonscelerisquetempor,purusquamdignissimdiam,cursuslaciniaurnarisusasapien.Duisetauguefeugiat,dignissimtellussed,rhoncusfelis.Integerporttitordapibusenimvulputateimperdiet.Ineulaciniaeros,fermentumporttitorligula.Vestibulumanteipsumprimisinfaucibusorciluctusetultricesposuerecubiliacurae;Morbiconvallisetligulaacvarius.Vivamuseuhendreritdiam,atincidunttellus.Nuncetleoegetleoconsecteturdictum.Pellentesquevitaediamante.Interdumetmalesuadafamesacanteipsumprimisinfaucibus.Suspendisseegetnuncacdolorauctorpulvinarsitametetenim.Aeneanaliquamurnanonquamrhoncus,acsemperjustoiaculis.Maurispellentesquetempormattis.Nuncatportaante.Suspendissequisfacilisisenim.Fusceconsequatlaciniafelis,tinciduntullamcorperturpisblanditut.Loremipsumdolorsitamet,consecteturadipiscingelit.Etiameuinterdumsem.Namefficitursuscipitegestas.Etiamlaoreet,felisnonaccumsanfinibus,exdiamaliquetsem,inconsecteturestleovelnunc.Proinfaucibusvehiculaegestas.Morbirhoncusornareerat.Sednonliberofelis.Fusceexdui,eleifendvelsagittisquis,laoreetacjusto.Vestibulumimperdietaccumsanelitsedmalesuada.Sedmolestienuncest,vitaepulvinarorcihendreritac.Donecsodales,erosethendreritaccumsan,estrisustemporjusto,idpulvinarnequedoloretnisi.Vestibulumanteipsumprimisinfaucibusorciluctusetultricesposuerecubiliacurae;Vivamusscelerisqueturpisnibh,bibendumtempustellusbibendumvel.Sedfaucibuslectusnonturpiscommodovenenatisvitaeacest.Donecetipsumacaugueluctusporttitoravelnunc.Donectinciduntenimlorem,euconvallisfelisfringillaeget.Duisiddapibusmi.Aliquamnecelementumlectus.Fuscequispretiumturpis,aclaciniadolor.Maecenasefficiturlectusvitaenibhmalesuadaaliquet.Morbimaximusviverravestibulum.Curabiturrutrumenimiaculisligulaefficiturfinibus.Aeneaninnislatrisusfinibusgravidaeleifendutsapien.Pellentesquequisorcinunc.Vestibulumtinciduntvulputatenisl,velcondimentumtortor.Interdumetmalesuadafamesacanteipsumprimisinfaucibus.Fuscelacusvelit,rhoncusquisviverraquis,sollicitudinindolor.Maecenasetfaucibusmassa,etluctusipsum.Maecenasiaculislacinialibero,acegestasleoscelerisqueat.Quisqueidaliquetelit.Pellentesquedignissim,nisisedvolutpatvestibulum,nisitortortempusvelit,sitametvenenatisurnaurnaatdiam.Nullamsagittisnibhanullahendreritpharetra.Pellentesquenislaugue,blanditatvestibulumet,aliquetnecleo.Crasdoloraugue,blanditmolestiemetusa,feugiategestasnisi.Sedvenenatisvelurnaacvarius.Aliquamporttitorodioidmattisgravida.Morbiviverrajustoetsemposuerelaoreet.Proinscelerisqueloremvitaeurnaeleifend,quisinterdumloremultrices.Nuncvolutpattinciduntfermentum.Donecacaccumsanjusto.Curabiturfinibusurnaacmagnamaximusviverra.Suspendisseacaliquetenim.Sedamattisarcu.Nuncmollis,nibhnecsempercongue,nisiestlobortisnunc,ettinciduntestauguevitaemauris.Vivamusinsapienidtortorlaciniaornarevitaenonante.Vestibulumeuduiporta,aliquamarcused,tempuslectus.Aeneanvelmattissapien,idfringillanibh.Nuncvitaepulvinarnisi,etaliquammassa.Vestibulumpretiumjustoincursusmalesuada.Quisqueamollismassa.Interdumetmalesuadafamesacanteipsumprimisinfaucibus.Nullaullamcorperpharetrafelisnonaliquet.Praesentegetgravidalibero.Namnonvehiculaipsum.Loremipsumdolorsitamet,consecteturadipiscingelit.Vestibulumsollicitudinrisusatlacusvulputatetincidunt.Duisnoncommodoex.Namateratcongue,sagittismaurislaoreet,mattisex.Vestibulumsuscipitfelisvulputatevenenatisultrices.Namestdolor,feugiategeterosvitae,aliquaminterdumsapien.Interdumetmalesuadafamesacanteipsumprimisinfaucibus.Sedportavelitsitametnequeconvallissuscipit.Vivamusfinibus,odioegetauctortristique,puruslacussodalesex,etconsectetursemrisuseurisus.Donecutvolutpatquam.Praesentmalesuadasedarcuquissuscipit.Quisqueantelorem,molestienonfermentumat,pellentesquevitaerisus.Aeneanmauristellus,vulputateegetmiquis,vehiculabibendumnisl.Nuncmaximuscursusdictum.Loremipsumdolorsitamet,consecteturadipiscingelit.Nuncegetjustoacnuncfermentumluctus.Etiamarculectus,vehiculanecmieu,variusdictumest.Suspendissepotenti.Nullameleifendauctornisiasodales.Donecvelduigravidaesteleifendporta.Proineumolestievelit.Namconsecteturelitpharetraaccumsanporta.Praesentegetmetussedodioauctorlaoreet.Nullamvulputatefaucibusornare.Proinfelisest,viverranonsemsed,dictumefficiturmi.Maecenassagittissapienatsodalesaliquam.Insuscipitneclacusnectincidunt.Curabiturlaoreetloremnecdolorviverraaccumsan.Namimperdietfacilisismagna,nondapibusurnaviverravitae.Namnecsemmagna.Maecenasfermentummalesuadasuscipit.Morbiidjustoconsectetur,tempusmetusac,facilisislacus.Proinefficiturvestibulumquametluctus.Nullagravidavariusmi,amattiseros.Proinhendreritnibhegestasmolestieposuere.Inhendreritdiamnonurnavehicula,blanditiaculiseratefficitur.Namaliquetdiamacexpellentesqueimperdiet.Aeneanblanditenimnonconsequathendrerit.Crasporttitor,augueutdictummaximus,tortorsemfermentumleo,ullamcorperlaoreetipsumlectusvitaeurna.Nuncfacilisismagnaidestgravidafaucibusquisinrisus.Aeneanaclobortismi.Inhendreritlectusidmaurisvestibulum,velaliquamodiotincidunt.Maurisvenenatisvulputatesem,inmattisnisiultriciessitamet.Fusceegetmetusinelitvulputatefinibusacadui.Duismolestieacurnaquispharetra.Inhachabitasseplateadictumst.Utidcursusaugue,sedtempusodio.Fuscemaurisquam,tinciduntsitametnislsitamet,vestibulumegestaslectus.Suspendissepotenti.Fuscevitaemolestieaugue,atimperdietturpis.Donecutaugueettortorvestibuluminterdum.Utnisimi,pretiumindolora,commodovehiculaturpis.Nullamegetmiidmiornarefringillaeuutmi.Namidtortorcommodo,tempormiat,dignissimleo.Morbietcongueex,necmalesuadaneque.Duiscommodo,turpisetpellentesqueblandit,enimdiamaliquammetus,utpharetraestsapienvitaeest.Vestibulumaccumsanposuereleovelscelerisque.Utconvalliseratinjustoimperdiet,eumaximusmassaeleifend.Curabitursitametleopurus.Aliquammattismaurissitametefficiturluctus.Duisultricesnislvitaeligulapulvinarcondimentum.Duiselementumdoloregetaugueiaculistempor.Proinacturpisaloremiaculisconvallis.Etiamturpisodio,placeratsitametcursusnon,aliquetinmetus.Phasellusrhoncussematvulputatelacinia.Vivamusatsemquisleointerdumfinibus.Proinmaximusblanditodio,egetconsectetursemaccumsanquis.Pellentesquehabitantmorbitristiquesenectusetnetusetmalesuadafamesacturpisegestas.Quisquesitametsagittissapien,egetelementumrisus.Donecnunceros,semperquisdignissimornare,fringillasedpurus.Aeneanmalesuadarisusetmattislaoreet.Namluctusegestaspurus,facilisisvolutpatnequesempereget.Aeneaniaculisauguedolor,acmollisnislpellentesqueid.Donecacmaurisnecmagnaportahendrerit.Sedaccumsanidodioacluctus.Morbinecegestasnisl.Duisvelsapiendui.Sedquismagnatempus,tinciduntlectuset,congueligula.Vivamuscursus,justovehiculadapibuspulvinar,estlectusplaceratturpis,egetmollisantenisiindui.Morbiatinciduntmetus.Etiameudolorvelit.Namsodalesnuncelit,amolestiedolorvestibulumeu.Loremipsumdolorsitamet,consecteturadipiscingelit.Maecenasporttitorplaceratligula,atvestibulumloremvehiculaat.Utcommodoarculaoreettellustempor,utluctuselitfeugiat.Sedtempusnequeintortorsodales,consecteturvehiculaerosfaucibus.Vivamusimperdietnequevelrhoncussuscipit.Maecenasnonsemquisduimollisporttitoreusitametnulla.Quisquepulvinarmassasitametsempermaximus.Nullamacnuncpharetra,finibuserata,conguemagna.Namvenenatisvolutpatsodales.Donecimperdiethendreritenim.Duistristiquegravidaarcuinporta.Pellentesqueefficiturleoeuleosuscipitpharetra.Aeneanullamcorpersollicitudinfacilisis.Nullaatmalesuadanisi.Quisqueconvallisnisiapulvinarefficitur.Nullamegetdiamtincidunt,facilisisfelisnec,tempornisl.Aliquameratvolutpat.Crasportadignissimurna,quismalesuadaeratdictumsed.Curabiturnecenimeununcsollicitudineuismod.Pellentesqueidegestaslectus.Integeratmassaidnibhvariuslaoreet.Proinacturpisacsapienfermentumpellentesque.Praesentvehiculaquisnisinonconvallis.Pellentesqueeuismodportaaugue,suscipitdignissimpurusullamcorpernon.Integerportaestnondolorullamcorper,acconsecteturduiultricies.Nullainterdumcongueturpis,idtemporlectussollicitudinid.Vestibulumaugueaugue,eleifendquisnequesed,rhoncusmolliselit.Nullasedenimodio.Vivamusquismisitameturnapellentesqueporttitoregetaneque.Maecenasaccumsanefficiturelitutmattis.Nullaaliqueteleifendfelis,asuscipitmetusposuereet.Aeneanrhoncusjustovelleomaximustincidunt.Suspendissesitametexidloremsollicitudinbibendum.Curabiturtempormaximusultrices.Sedjustotortor,tinciduntegetmolestieet,facilisisposuereex.Sedidurnarisus.Crassapienerat,efficituretconguenec,portautmassa.Vestibulumaportapurus.Ututtellusfeugiat,vestibulummassaut,hendreritligula.Utidnisicursusrisusfeugiatfaucibusinterdumegetlorem.Aeneanatnullaconvallis,mattisliberosed,consecteturvelit.Crasligulatellus,viverraataugueat,maximusaliquetnulla.Phasellusnequeodio,placeratpulvinarvestibulumporttitor,molliseulorem.Quisqueconvallisporttitornunc,inportaorciimperdietsitamet.Suspendissedapibusiaculisvelit,aullamcorpermauriseuismodeu.Inporttitorurnaluctusleoimperdietgravida.Pellentesqueeuarcualiquet,temporquameget,vestibulumlorem.Namelementumtortorsitameteratfeugiatluctus.Loremipsumdolorsitamet,consecteturadipiscingelit.Fusceutdignissimvelit.Nuncfinibusnisiaclacuscongue,egetportamassavolutpat.Vestibulumsedlacusutsemimperdietluctus.Namdolorquam,porttitornonsemeu,euismodluctusest.Nullavelittellus,tristiqueatsemperac,gravidasedante.Prointinciduntdignissimrisus,etportaarcupellentesquevel.Sedrhoncuserosvitaetristiquerutrum.Curabiturdictumnullasedvenenatisconsequat.Praesentsodalestellusrisus,nontempuseliteleifendvitae.Innonurnadictum,pretiumjustoa,lobortismagna.Inliberoipsum,bibendumnecaliquamnec,pharetracondimentumante.Pellentesquegravidaenimegetblanditscelerisque.Fuscerutrumporttitormollis.Nullamelementumconsequatquam,aconsequatsapienbibendumac.Fuscenislest,ullamcorpersedipsuma,dapibuspulvinarodio.Utelitnulla,auctoratrhoncusut,imperdietaclectus.Duisincondimentumest.Quisquealiquetacrisusvelaliquam.Inestnisi,tempusutloremid,rutrumpretiumleo.Nullaegetenimelit.Maecenastempuspharetraurna,velscelerisqueerattristiqueeget.Nuncnibhligula,pretiumlaoreetmalesuadaet,mollisegetlacus.Vivamussagittisdignissimorci,quiseuismodaugue.Vestibulumutmaximusdiam.Mauristortortortor,malesuadaegetmalesuadaeu,mollisinturpis.Etiamsuscipitatmagnaneceuismod.Curabiturleoenim,ullamcorpersedturpisin,cursusmalesuadafelis.Phasellusquiseratinmetuscondimentumcursusvitaesitametpurus.Sedfermentumquametsemfinibus,vitaedignissimfelisefficitur.Aeneanvestibulumerossitametmassalaciniafermentum.Proinornareornarenunc,utconvallisjustoluctusquis.Morbiipsumest,ornarequisconsectetureget,posueresedante.Nuncmolestieultriciesmauris,sitametsollicitudinmassacommodoat.Crasodiodiam,faucibusutgravidanec,convalliseuex.Sedvitaefermentumenim.Integertristiquearcuidfringillavarius.Donecegetcursusneque,nechendreritenim.Integervehiculaleovenenatissemperconvallis.Inmetuslibero,consecteturinleonon,aliquetdictumorci.Inrisusorci,ornarevitaelobortiset,malesuadaeunisi.Aliquamiaculispuruscommodo,imperdietdiamlobortis,scelerisqueeros.Nullamfacilisissemsapien,idconvallisvelitvulputatesitamet.Sedporttitorimperdietarcu,quislaoreetenimrutrumid.Crasvelelementumdui.Praesentsodaleshendreritdolorsedvehicula.Suspendissevitaetemporaugue,insodalesturpis.Morbieuiaculisipsum,idvenenatisleo.Morbidictumfinibuseros,insempertortorlobortisvel.Duisullamcorpersemluctusrisuslaoreet,sitamettempusjustoeleifend.Quisqueegetlacustincidunt,ultriciesmagnaeu,rhoncusnulla.Suspendissecursustempuspulvinar.Utullamcorperaccumsanrisusidrutrum.Curabitursednullaaipsumsagittisconvallisnecuterat.Morbiutimperdietnisi.Morbiloremtellus,temporveldoloreleifend,egestastristiqueleo.Suspendissemattislobortismaximus.Donecipsumlorem,sollicitudinaerosnon,laciniaeleifendturpis.Suspendisseeulacusquisodiorhoncusfinibus.Maecenassedaccumsanorci.Proinconvallissollicitudineros,atristiquenequeblanditnon.Aeneanconsecteturaliquamleo,idscelerisquediam.Morbiimperdietvitaedolorutscelerisque.Namfaucibusduiex,vitaetinciduntpuruspharetravel.Maurisligulaneque,fringillaquismattisquis,euismodinfelis.Namfeugiatnuncquisvelitelementumefficitur.Utetporttitorerat.Vestibulumfeugiaturnaiderosfringilla,etplaceratsapienporttitor.Curabiturtinciduntatnullasitametelementum.Suspendissehendreritfacilisisfacilisis.Etiamlaoreetfelisinviverrafinibus.Etiamutpulvinaraugue,sedtincidunterat.Quisquefinibusscelerisqueviverra.Etiamcondimentumdapibuselitquisvarius.Namvolutpatleonecmagnadictumhendrerit.Vestibulumnonaliquamrisus,acplaceratodio.Sedeleifendtristiqueiaculis.Donecdignissimrisusfinibus,finibusdiama,vulputatevelit.Phasellusacsuscipitlectus.Sedeuefficiturmassa.Donecfelisdiam,dignissimnoneuismodvenenatis,fringillanecaugue.Fuscefacilisiselitatvolutpatpharetra.Namacquamvelrisusauctoreuismodutnonante.Vivamusutliberosollicitudin,ornarenuncid,imperdietjusto.Crasefficiturconguelacus,noninterdumsemeuismodsed.Morbivitaeerostincidunt,sollicitudinnisisitamet,volutpatquam.Duisrutrumtempusarcu,acaliquamexcongueac.Utlacusdiam,fermentumutconvallisut,semperutaugue.Etiamtempus,maurisquisfeugiatporta,nunctelluspharetraerat,acsollicitudinduinequevitaenisi.Maurisportafacilisisdiam,quisaccumsannislmattissed.Aeneanfeliseros,pellentesqueeusagittisnon,vulputatecondimentumpurus.Nullampretiumposuereanteintempus.Namnoncommododolor,idrutrumsem.Vestibulumantejusto,condimentumnonnisleu,dignissimmaximusaugue.Integernonsapienutpuruslobortisfermentumnecvelnulla.Fusceidenimfinibus,ullamcorpersemat,ullamcorpertortor.Donecamalesuadarisus,veldictumtortor.Naminrisusmi.Vestibulumestdiam,convallisvitaedictuma,pulvinarsedlectus.Aliquamposuerenisietelementumdictum.Sedaclacusacnisilaoreeteuismodnonegestasex.Crassedornareest.Phasellussedfinibuslectus,idvestibulumturpis.Etiamaimperdietrisus,idconvallisrisus.Phasellusorcierat,dictumaelementumac,placeratsedtortor.Etiambibendum,purusinsagittisposuere,augueipsumegestasurna,eupulvinarnullaleoeuex.Nuncmolestiepellentesquelibero,etplaceratfelislaoreeteu.Nullavenenatisestquisenimfaucibusullamcorper.Vestibulumlectusaugue,placerategetduised,vehiculaeleifendvelit.Donecasuscipitorci,atcommodonulla.Nameuporttitorodio,quisdictumnisl.Utvestibulum,felisacrhoncustincidunt,nuncmetusluctuslorem,egetfeugiatmaurisnislegetorci.Nullamdignissimvitaerisusinsodales.Sednecenimgravida,lobortisurnahendrerit,viverrapurus.Morbivolutpatligulaeuaugueposuere,etlaciniatellusmolestie.Nullavelefficitureros,quisfaucibusmagna.Phaselluseuiaculisodio.Morbivelleolobortis,malesuadaurnaid,facilisisneque.Quisquenontelluscondimentum,facilisisligulased,venenatislacus.Maecenasarcumauris,placeratetfacilisisin,malesuadaasem.Fusceidrisuseurisustempusdignissim.Sedvitaeconvallismi,velpretiumpurus.Vestibulumelitlibero,interdummolestieeleifendsitamet,molestievitaevelit.Vestibulumeleifendaccumsanrisussitametmalesuada.Vestibulumfinibuseleifendhendrerit.Inauguefelis,luctusvitaelectusa,eleifendiaculisneque.Nuncsitametsapienvitaesapienornarealiquam.Proinportatortorseddiamegestas,sedluctussemplacerat.Sedquisnequeanisirutrumfaucibusvitaeaclacus.Maecenasnecinterdumelit.Praesentvitaenislmollis,mattisnequeac,dapibusturpis.Phasellustellusnisl,sempernecaliquamsitamet,facilisisfaucibusnulla.Maurisplacerattortorvitaeultriciesfermentum.Vestibulumfacilisismagnavelscelerisqueconsectetur.Fuscesitametornarejusto.Interdumetmalesuadafamesacanteipsumprimisinfaucibus.Vivamusametuscursus,aliqueturnased,suscipitnunc.Quisquevitaepurusauctor,tinciduntexa,imperdietodio.Donecaccursusquam.Sedvehiculanibhetnisleuismod,vitaerutrumquamegestas.Vivamusdapibusdolorposuereelitblandit,nonvolutpatmilaoreet.Utdictumornareipsumacscelerisque.Quisqueeucursuseros.Nullamvitaeipsumvelnequepellentesquegravida.Namatnisisem.Maecenasliberometus,eleifendsedduiac,cursustempusante.Doneceuleodictum,pulvinarliberoac,pharetraligula.Sedsitamettinciduntelit.Utatmollistellus,eusodalesnulla.Etiamcursusidloremnonfacilisis.Namaliquamegetleonecdapibus.Integerutnuncmalesuada,dignissimorciut,maximusvelit.Classaptenttacitisociosquadlitoratorquentperconubianostra,perinceptoshimenaeos.Loremipsumdolorsitamet,consecteturadipiscingelit.Nullasedcommodourna.Sedquisullamcorperneque.Sedlobortis,turpiseubibendumegestas,semmagnainterdumnibh,eleifendpharetranisiligulaquistortor.Nullamatliberolacus.Namornaremetusacleoaccumsanconsequat.Etiamullamcorpernisleulobortistincidunt.Vivamusconguefaucibuslacusutvolutpat.Donecsodalesurnaenim,etsuscipitligulaaliquamin.Phasellusportanonerosidfaucibus.Nuncmalesuadainterdumarcu.Nullametfaucibusaugue.Phasellusluctusmagnajusto,sitametaliquamerosultricessitamet.Fuscenibhligula,tinciduntfeugiatmalesuadaut,temporeturna.Vivamusornarevelitegetvelitplaceratsemper.Maecenastemporvulputatearcu,quismaximuselitauctorsed.Vestibulumvelportaquam,vitaefacilisisneque.Etiamgravidaquamvelerospharetrascelerisque.Phasellustincidunt,nuncetcommodosemper,nisinisisemperodio,quisullamcorpermassasemvitaepurus.Etiametnullavitaequamullamcorperportavitaeetelit.Inrhoncusmetusatvolutpatmolestie.Nuncpretiumleononlaciniarhoncus.Namscelerisquelaoreetultricies.Fuscebibendumnullafinibustristiquesemper.Fusceporttitor,duiutpretiumpulvinar,orcinisiconvalliselit,nonporttitoreratlacusvitaelacus.Praesentportaturpisipsum,egetaccumsananteconsecteturcommodo.Quisquejustojusto,scelerisquevelmaximusluctus,posueresedlectus.Phasellusnontortornecfelistinciduntvenenatis.Maecenasodioarcu,eleifendatliberoat,auctormolestieodio.Morbisollicitudinleoidvulputatelobortis.Vestibulumsedurnainexornareluctusidneceros.Nuncblanditegetlacusinterdumdictum.Maurisportalaoreetleosedrhoncus.Nuncvitaebibendumfelis.Sedvitaenibhjusto.Vivamusquisblanditenim.Inluctusmetusutmassatincidunt,vitaemaximustellusfeugiat.Nuncaarcuscelerisque,commododoloreu,malesuadaerat.Sednecipsumnecligulaeleifendtempussedvelligula.Pellentesqueveliaculistortor.Phasellussitametpurusviverra,fringillaorcinon,ultricesmagna.Inenimdolor,eleifendactellusnon,tinciduntaliquettortor.Proinfacilisismiseddiamfeugiataliquam.Fuscevestibulummassanecmagnasuscipit,etvestibulumestcursus.Vestibulumfaucibusmetussitametnequeportablandit.Vivamusefficiturlobortisnisietconvallis.Duisquisnisinecnibhsollicitudinsagittisutsitametneque.Maecenasfermentumcommodoest,necdapibusdiamtristiqueeu.Mauriscursusdiameuturpisposuerevarius.Ututorciiaculis,vehicularisusnec,lobortistortor.Vestibulumanteipsumprimisinfaucibusorciluctusetultricesposuerecubiliacurae;Uteumivulputate,euismodvelitquis,pharetraarcu.Maecenasetnullametus.Proinvulputatecursusnequeetsemper.Fuscesodales,exsuscipitcommodoscelerisque,nunceratscelerisqueex,atvestibulumsemurnaacurna.Aliquamfacilisistortorligula,sitametgravidanibhvariustristique.Aeneaninultriciesrisus.Suspendisseultriciesvehiculaloremaceleifend.Vestibulumanteipsumprimisinfaucibusorciluctusetultricesposuerecubiliacurae;Sedturpislectus,sollicitudinsedaccumsanid,vehiculavellorem.Proinauctorlacussedtellustinciduntullamcorper.Classaptenttacitisociosquadlitoratorquentperconubianostra,perinceptoshimenaeos.Nunclobortisauctorrisus,sedlaciniasapienluctussitamet.Pellentesquequisnisidiam.Curabituratsagittisdui,atvestibulumnunc.Nullafacilisi.Nuncdapibuseratatarcupellentesquecongue.Nullammetusnibh,scelerisqueegetfringillaid,porttitorvariusligula.Quisquesuscipitestanibhornare,idrutrumnibhrhoncus.Vivamusutplaceratipsum.Quisqueetjustomauris.Donectempusquisnequefeugiatelementum.Nullafringilla,tortoridvenenatismalesuada,ipsumnunclobortisex,egetcommodomagnadolorutodio.Etiamplaceratmetusvitaequammattisvulputate.Phasellustinciduntmetusidaccumsanullamcorper.Prointincidunteratsitametsapieniaculis,ettinciduntturpistincidunt.Morbivulputateimperdietegestas.Vestibulumanteipsumprimisinfaucibusorciluctusetultricesposuerecubiliacurae;Etiameleifendtortorsedarcumollis,nonvehiculaerosbibendum.Quisquedapibusnequepurus,euconvallisanteauctornec.Aliquammaximustinciduntmaurisaccommodo.Phasellusutmiutnuncconsectetursodales.Suspendisseutturpisvenenatis,facilisisleonec,volutpatligula.Donecegetinterdummi.Fuscesemperquamlectus,etconsecteturmetuselementumnec.Morbisempervelitatfelispharetracongue.Classaptenttacitisociosquadlitoratorquentperconubianostra,perinceptoshimenaeos.Donecconvallissapienegetultriciesviverra.Inlectusmassa,dignissiminmalesuadanec,feugiatcommodoenim.Maecenassedmalesuadalacus,inpulvinarnibh.Uttempordictumnislegetluctus.Maurisloremdui,elementumneceuismodeget,consequatlaoreetante.Etiamscelerisquenibhacdapibuspulvinar.Etiamiddapibusaugue.Fusceimperdietipsumlectus,velmattisestauctorsitamet.Aliquameleifendornaremi.Quisquevelitodio,eleifendeufaucibu